40+ ideal debt to income ratio for mortgage

Web Use this simple formula to find your debt-to-income ratio. 50 is a common limit but some lenders are more cautious.

Debt To Income Ratios Home Tips For Women

Ideally lenders prefer a debt-to-income ratio.

. Contact a Loan Specialist. Heres how lenders typically view DTI. Ad Compare Best Mortgage Lenders 2023.

The person in this. 03 x 100 30 or 30. Web How much debt is acceptable for a mortgage.

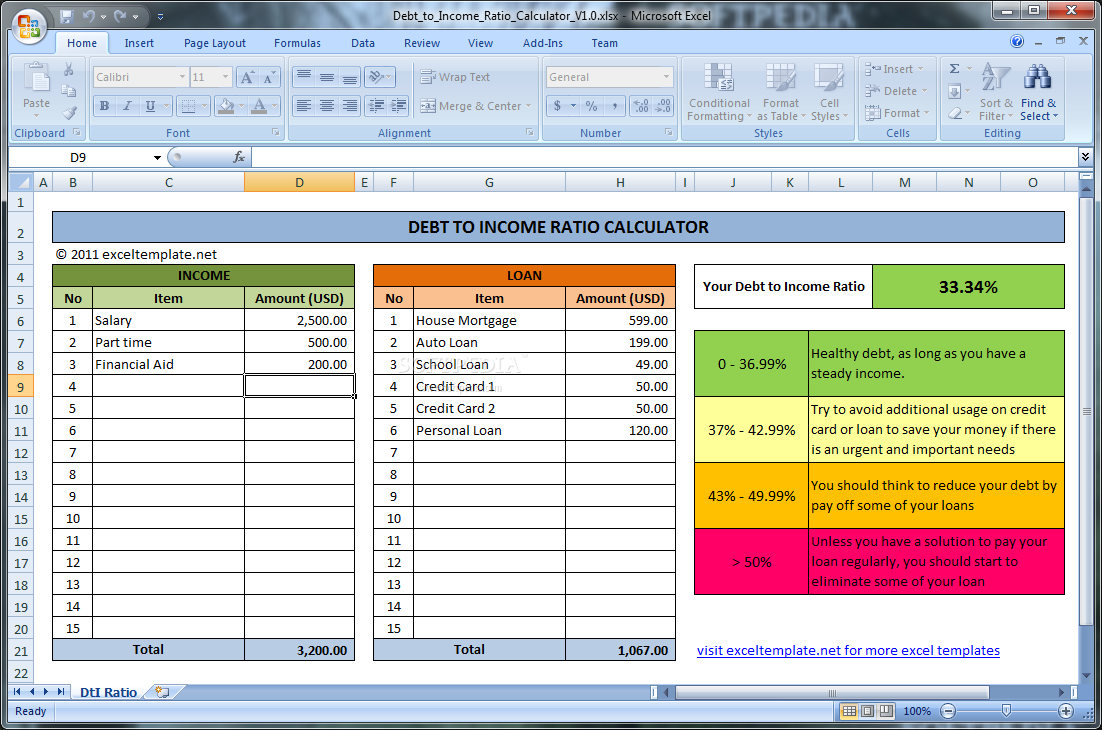

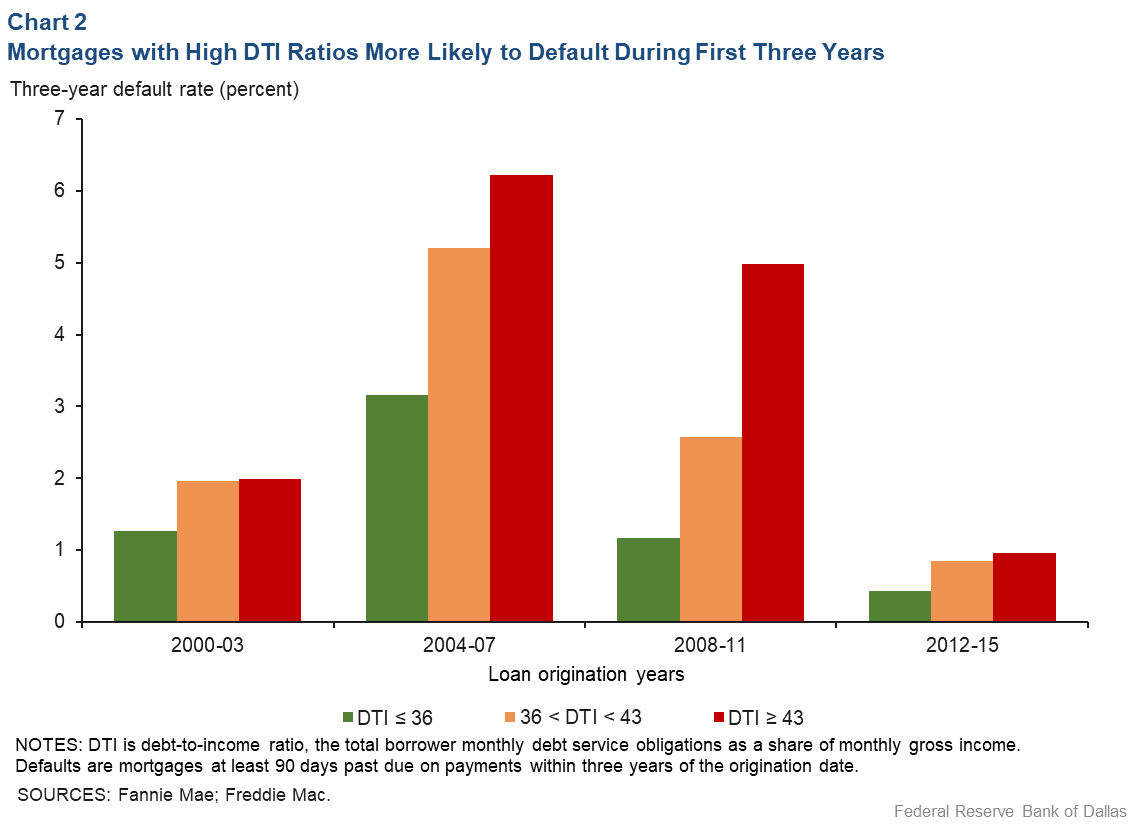

Web As a general guideline 43 is the highest DTI ratio a borrower can have and still get qualified for a mortgage. Monthly debt obligationsdivided byMonthly incometimes100equals DTI For. Web A debt-to-income ratio of 35 or less usually means you have manageable monthly debt payments.

Monthly Debt Payments Gross Monthly Income DTI You can multiply this number by 100 to get a. Ad Eased Requirements Make Qualifying For Lower Rates A Snap. Web To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments.

Web The QM rules began after the housing crisis to keep lenders more accountable and borrowers choosing smarter loans. Web In January 2023 FHFA announced redesigned and recalibrated grids for upfront fees in addition to a new upfront fee for certain borrowers with a debt-to-income. Web Your monthly debt payments would be as follows.

Depending on the size and type of loan theyre issuing lenders set their own. Web A debt-to-income ratio of 20 means that 20 of your income is going toward debt payments. According to the Qualified Mortgage Guidelines.

900 3000 03. Web How to calculate your debt-to-income ratio. Web Ideally lenders prefer a debt-to-income ratio lower than 36 with no more than 28 of that debt going towards servicing a mortgage or rent payment.

Web As a rule of thumb you want to aim for a debt-to-income ratio of around 36 or less but no higher than 43. VA Loan Expertise and Personal Service. Apply Online Get Pre-Approved Today.

Web There is no perfect DTI ratio that all lenders require but lenders tend to agree a lower DTI is better. Get Your Quote Today. To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments.

Web DTI measures your debts as a percentage of your income. Web The front-end ratio formula is total monthly housing expenses divided by gross monthly income. This includes cumulative debt payments so think credit card.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Ad Eased Requirements Make Qualifying For Lower Rates A Snap. Web Lenders generally view a lower DTI as favorable.

1200 400 400 2000 If your gross income for the month is 6000 your debt-to-income ratio would. Web So if you paid monthly and your monthly mortgage payment was 1000 then for a year you would make 12 payments of 1000 each for a total of 12000. Most lenders will lend below 100 debt-to-income ratio.

Debt can be harder to manage if your DTI ratio falls between. But with a bi-weekly. It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan.

Opportunity to improve Youre managing your debt adequately but you may want to consider lowering your DTI.

Debt To Income Ratio Calculator 1 0 Windows Download

Debt To Income Ratio Calculator What Is My Dti Zillow

How Much Mortgage Can I Afford Comparewise

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

These Are The Countries With The Biggest Debt Slaves And Americans Are Only In 10th Place Wolf Street

The State Of The American Debt Slaves Q3 2018 Wolf Street

How To Calculate Your Debt To Income Ratio Rocket Money

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

How To Calculate Debt To Income Ratio For A Mortgage Or Loan

Taxpayers Face 435 Billion In Student Loan Losses Already Baked In Leaked Education Department Study Wolf Street

43 Debt To Income Dti Ratio Limit Will Shink The Mortgage Market

What Is Debt To Income Ratio Omaha Ne Home Buyer S Guide Petrovich Team Home Loan

Debt To Income Ratio Dti What It Is And How To Calculate It

Debt To Income Ratio What It Is How To Calculate Yours

What S An Ideal Debt To Income Ratio For A Mortgage Smartasset

Debt To Income Ratio For Mortgage Definition And Examples

Ability To Repay A Mortgage Assessing The Relationship Between Default Debt To Income Dallasfed Org